Stuart Owers and Dev Sharma, publish their thoughts on these current hot topics.

With continuing market volatility and the associated reductions in available funding, risk managers have to stay firmly on top of their liquidity requirements. Careful system selection that delivers the appropriate reporting tools is an essential component in a successful liquidity risk management strategy – without this in place, there is a very danger of getting caught without the appropriate cash flow required for efficient operation.

The risk landscape is getting ever rockier, as the global market turmoil continues and regulation gets even tougher. The fact remains that regulation is only going to get tougher, irrespective of whether organisations have failed to apply sufficient risk mitigation strategies in the past, or whether the new regulations demand too much complexity too quickly. This process is certainly going to be further accelerated by the damaging impact of activities as illustrated in the recent UBS news headlines. Organisations that fail to face up to the new regulatory world are at best only postponing, or at worst augmenting the cost and challenges of addressing it.

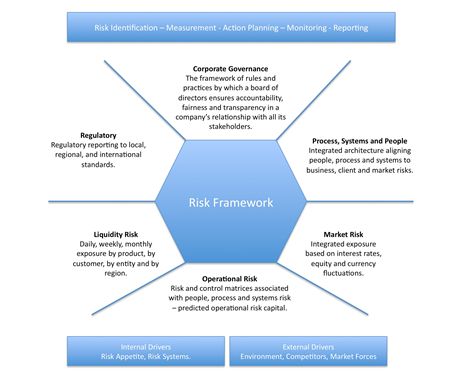

It is therefore no surprise that ‘risk framework’ is the corporate buzzword of the moment. Everyone wants one, reflecting recognition of the pressing need to ensure that liquidity risk strategies are robust, effective and flexible. Risk needs to be properly tasked, funded and governed. There are a myriad of options to weigh up, and ever more complex regulations to contend with – as illustrated by the introduction of Basel III, with its potentially conflicting implications for both liquidity and solvency. Liquidity operations represent a key element to any risk framework. Overall, the challenge is to develop an effective risk management policy that reduces exposure without constraining business flexibility, matching an appropriate structure and risk appetite to an organisation’s selected markets, trading environment and business objectives.

The Impact of Recent Events

Post Lehman’s bankruptcy, the financial market suffered a liquidity crisis that had not been experienced since the Great Depression of the 1920s. With financial institutions’ balance sheets heavily exposed to sub-prime debt, inter-bank liquidity disappeared as institutions felt that they could not expose themselves further to possible bankruptcy from others. Central banks, as lenders of last resort, created financial facilities (through the Troubled Asset Relief Programme (TARP) and quantitative easing (QE)) to enable liquidity by purchasing any securities, regardless of rating. This led to a crisis of confidence, where the normal overnight market no longer trusted each other’s ability to meet their funding commitments. Three years on, the market still has liquidity issues, due to the possible default of European sovereigns. Central banks have again stepped in to provide US dollar funding that institutions need in order to ensure their funding commitments are maintained.

The credit crisis taught us that there was a clear need for fundamental changes in risk management practices. And the learning curve is still continuing. It is too early to tell whether the recent UBS issue was due to a lack of a structured approach to risk or was purely brought on by fraudulent activity. A risk framework cannot prevent such eventualities such as the lack of adhering to controls, fraudulent activities or rogue traders. It can, however, highlight them at a much earlier stage through accurate reporting based on a structured framework, thereby limiting the impact. It stands therefore, that any risk framework needs to have the correct level of controls associated to it, taking into account organisation’s operation and its appetite for risk.

Devising an Effective Risk Framework: The Considerations

There is no easy route to realising a liquidity solution. The often-adopted belief that implementing a liquidity risk control will result in a liquidity solution is completely false. It is essential to define a structured approach to risk as a whole, throughout an organisation, and as such liquidity risk forms in integral part of an entire risk framework. Even the Financial Services Authority (FSA) has demonstrated its acceptance that it is not possible to remove risk entirely from the financial system. It does, however, regularly review how much risk it is prepared to tolerate. The same applies to corporations – where risk will always exist to a certain degree. The level needs to be effectively determined, managed and reviewed via a well-conceived and executed structured risk framework.

When dealing specifically with liquidity risk, the regulations clearly state that committed credit or liquidity facilities cannot be leveraged. During the 2007-2008 credit crises, many organisations decided to conserve their own liquidity or reduce their exposure to other banks. This strategy can cause a knock-on effect that sends shockwaves through the financial institutions, making those that are over-leveraged in serious danger of default or collapse. As a result, the ability to report clearly on current status and liquidity exposure has never been more important.

The regulations clearly stipulate that an organisation must not be over-leveraged. It follows that in order to effectively manage its liquidity risk, an organisation must ensure that it has the effective means of which to monitor and report on it. This requires the correct monitoring tools and metrics to be put in place, with readily available reporting. As liquidity risk covers the reflection and management of open market positions and commitments, it is a prerequisite to implement an effective system in which to report such positions. This is where an effective risk framework comes into its own, providing the tools to not only highlight the risk, but also to report on and provide meaningful up- to-the minute information. Never has the phrase “knowledge is power” been more appropriate. With the correct knowledge base, it is within an organisation’s power to manage and mitigate any upcoming risks truly effectively.

We have also seen another paradigm shift with the recognition that liquidity is no longer restricted to just emerging markets or obscure stock, but can in fact be widespread. This has been witnessed with increasing regularity even in the most established of markets.

As already stated, a successful risk framework must effectively control, manage, escalate and in turn mitigate or process any associated risk. A miss-sold, incorrectly designed or wrongly implemented framework can have long-lasting, detrimental and potentially catastrophic effects – actually reducing a large corporation’s revenue stream if it is too risk averse, or placing unnecessary risk on a trading structure that witnesses very little gain. Devising an appropriate risk framework is about achieving balance and harmony within an organisation, enabling proactive risk management without restricting growth or adding layers of red tape to any trading process.

System Considerations

There are many risk platforms and systems in the market, offering varying degrees of complexity and solution-based processes in and around risk management. Finding the most appropriate solution for a particular organisation relies on a careful process of review and needs assessment. There is a very real danger associated with driving risk management by system selection, leading to the misconception that investing in the ‘best’ system is a simple way of resolving all risk management issues. As with enterprise risk planning, customer relationship management (CRM) and other business enterprise systems, it is imperative to understand both your business and the data you need in order to get the best out of the system. There are many systems on the market, but experience shows us that when defining an all encompassed risk management framework, it is imperative to understand the business requirement before going down the system selection route.

Getting to Grips with Liquidity Risk Management

With regulators, investors, shareholders and boards all demanding a much more structured and transparent approach to risk management, what are the options on the table? There are many risk management systems in existence that offer the ability to develop and build specific scenarios relating to liquidity risk, thereby ensuring that any funding gaps are negated. A system also needs to be able to forecast funding and liquidity requirements accurately over various time horizons.

In the future, liquidity risk will only become more regulated, with tighter controls being enforced on organisations to ensure they have adequate funding and reserves to meet their cashflow commitments. The painful lessons of the past three years have demonstrated the need to ensure that not only are interbank facilities in place to ensure that funding can be met, but also that internal controls are well-defined, supported by good systems to enable the liquidity risk profile to be well understood by all levels of management. This latter point was recently enforced by London risk manager Daniel Geoghegan, when he was quoted as saying: “Best practice in risk management through a well-defined risk framework needs to be constantly monitored and refined, so that it is in adherence to any new regulations; and therefore it is imperative that any new framework be allowed to reflect any new regulations. This requires organisations to take a strong, dynamic and pragmatic approach to their liquidity risk operations to ensure that there is no exposure to the organisation in mitigating any potential risk losses.”

Conclusion

With continuing market volatility and the associated reductions in available funding, risk managers have to stay firmly on top of their liquidly requirements. Careful system selection that delivers the appropriate reporting tools is an essential component in a successful liquidity risk management strategy – without this in place, there is a real danger of getting caught without the appropriate cashflow required for efficient operation.